A Practical Path Through TNFD: Dunya Analytics' Platform for Nature Risk Reporting

Nature-related risks are complex and deeply local. They stem from interconnected pressures - land-use change, ecosystem degradation, water stress, biodiversity loss - and vary widely across geographies and value chains. These risks carry financial, operational, and reputational consequences and are increasingly shaping disclosure regulations and stakeholder expectations.

Yet turning environmental complexity into actionable insight remains a major challenge for ESG and risk teams. Traditional tools weren’t built to handle the spatial and thematic granularity needed for nature, but this is where platforms like Dunya Analytics come in - specifically designed to structure fragmented data and support credible, scalable nature reporting.

In a recent NTC Now session, Megan Pilsbury, CEO & Founder of Dunya Analytics, shared how their platform is helping organizations make sense of complexity, helping to bridge the gap between ecological data and credible, actionable nature disclosures.

Watch the playback

What are nature-related disclosures, and why do voluntary frameworks like TNFD matter?

Nature-related disclosures are structured assessments of how a company both impacts and depends on the natural environment. They aim to bring transparency to the risks and opportunities that stem from biodiversity loss, land degradation, water scarcity, and more.

Frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD) provide structured guidance for companies on how to assess and report these risks. TNFD also helps companies anticipate future regulation, build internal systems, and improve investor confidence by showing they understand and are acting on nature-related risks.

Unlike regulatory mandates, voluntary frameworks are not legally binding, but they do set a clear direction of travel. Voluntary frameworks are especially important because they:

Provide a roadmap where no global standard yet exists.

Harmonize emerging reporting requirements (e.g. TNFD aligns with the EU’s CSRD).

Help companies move from reactive compliance to proactive strategy.

How did the TNFD come about?

The TNFD was created in 2021 by an industry-led coalition to improve financial and corporate responses to nature loss. It draws on global consultation and builds on decades of conservation and ecosystem research.

The framework is structured around four pillars: governance, strategy, risk management, and metrics/targets. Central to its approach is the LEAP process, a four-step methodology that guides companies through the following steps:

What About SBTN? How Does It Connect to TNFD?

The Science-Based Targets Network (SBTN) works alongside TNFD, focusing specifically on target-setting. If TNFD helps companies assess and disclose their risks, SBTN guides them in setting measurable goals for reducing environmental impact.

For example, SBTN has developed methodologies for freshwater, land, ocean, and biodiversity, and the frameworks are intentionally cross-referenced: TNFD assessments help prepare the data foundation needed to engage with SBTN targets.

In order to meet nature disclosure requirements, companies are encouraged to:

Start with TNFD to understand their nature risks and impacts.

Use that understanding to develop action plans and measurable SBTN-aligned targets.

Evolve from disclosure to strategy, and ultimately to positive environmental outcomes.

Dunya Analytics: Turning framework complexity into practical action

Frameworks like TNFD and the Science-Based Targets Network (SBTN) have emerged to bring coherence to nature risk reporting. They offer strategic direction, but for many organizations, the operational leap from guidance to implementation remains a sticking point.

Dunya Analytics helps bridge that gap. By aligning assessments to TNFD’s LEAP process, the platform not only ensures compatibility with emerging regulatory standards (such as the EU’s Corporate Sustainability Reporting Directive, CSRD), but also helps businesses mature from fragmented, reactive disclosures to proactive, strategy-aligned planning.

The vision behind Dunya Analytics is grounded in both personal experience and industry insight. Its founder, Megan Pilsbury, came to the nature risk space by way of a multidisciplinary journey, starting in electrical engineering, moving through high-tech startups and financial services, and eventually working at a climate risk analytics firm that was acquired by S&P Global.

That experience revealed a clear pattern: when companies could see climate risks translated into financial terms, they paid attention. And when reporting frameworks began shifting toward nature, it was clear that businesses would need new tools to keep pace.

Recognizing that the underlying governance and ESG structures were already being put in place, thanks to years of climate-related groundwork, Megan saw an opportunity. Dunya Analytics was founded to meet that moment. It bridges the gap between emerging nature-related frameworks and practical, scalable tools companies can use today.

How Dunya Analytics helps companies apply the TNFD framework

In practice, many organizations struggle to operationalize LEAP due to data fragmentation and resource constraints.. While many tools in the space focus on data aggregation, Dunya Analytics offers a stepwise, end-to-end structure for operationalizing nature risk. The platform enables organizations to move beyond static reports and into a dynamic process that supports instant risk identification and strategic response.

At the heart of the Dunya Analytics platform are three integrated capabilities:

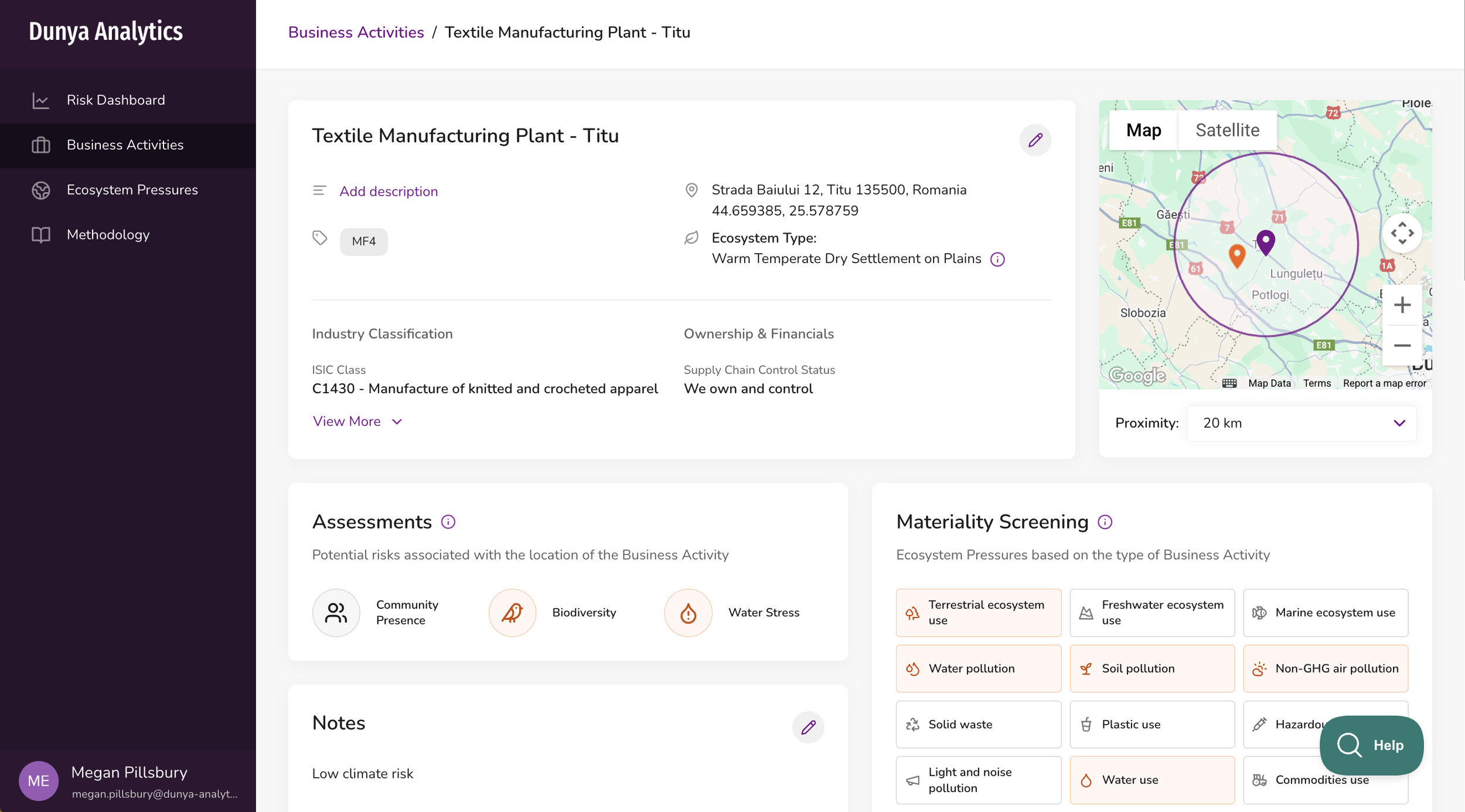

1. Geospatial Screening of Assets and Operations

Users can evaluate entire portfolios or individual sites across a curated library of environmental and social datasets. This includes layers for water stress, biodiversity risk zones, ecosystem integrity, land-use pressures, and proximity to protected or culturally sensitive areas. One key differentiator is the inclusion of social-environmental overlays, such as indigenous territories, which help organizations consider both environmental and human-rights-related risks in one view.

This geospatial screening empowers organizations to quickly determine where they operate in or near areas of ecological or social significance, critical for aligning with TNFD’s Locate and Evaluate steps.

2. Modular, TNFD-Aligned Risk Assessments

Built around the TNFD LEAP (Locate, Evaluate, Assess, Prepare) approach, the platform allows for flexible configuration of assessments based on geography, industry, supply chain footprint, or business value. Companies can view a menu of risk indicators and contextual datasets to evaluate exposures, dependencies, and impacts in ways that reflect their specific business realities.

This modular approach not only helps satisfy disclosure requirements but also guides internal teams toward a deeper understanding of their nature-related risks and opportunities, making assessments both credible and repeatable.

3. Scenario-Ready Outputs and Workflow Integration

Unlike static consultant-led studies, the outputs from Dunya Analytics are designed for continuous use. Assessments can be revisited as site conditions evolve or new data becomes available. Insights can be directly integrated into enterprise risk management, sustainability strategy, and operational planning.

Crucially, the platform provides layered transparency. High-level summaries are digestible for business leads, while deeper methodological documentation supports scrutiny from scientific, legal, or compliance teams. This balance of accessibility and rigor enables broader internal alignment and better decision-making.

What sets Dunya Analytics apart is how it connects insight to action. Once high-risk sites are identified through geospatial screening, companies can engage relevant partners, whether for local diagnostics, community engagement, or restoration planning. The platform not only supports disclosure but also guides strategic investment, helping organizations prioritize where to act and how to make those actions count.

Real-World Example: From Screening to Restoration in the Value Chain

One Dunya Analytics customer recently identified a high-priority site within their supply chain. The screening flagged significant environmental stress in an area with community-led agricultural activity. Rather than stop at disclosure, the company decided to launch a restoration project with their supplier as a key stakeholder.

To support this effort, Dunya Analytics helped connect the company with other Nature Tech Collective members specializing in:

Baseline ecological measurements

Community engagement

Progress tracking and outcome verification

The goal was not only to improve environmental performance, but to make verifiable claims about nature-positive outcomes. This created a strong internal business case for investment, while ensuring credibility with external stakeholders.

Practical First Steps: Getting Started Without the Overwhelm

One of the most common questions for companies new to nature disclosure is: Where do we even start? The short answer? You don’t need to have everything figured out to begin, and you likely already have more than you think:

Start with what you already have. Many companies have already collected location-based data as part of their climate reporting. That same information—facility coordinates, site activities, supply chain locations, forms the foundation of a TNFD-aligned nature assessment. You don’t need to start from scratch.

Use tools designed for this journey. Platforms like Dunya Analytics are purpose-built to take in basic business data and instantly return useful insights. Even without a dedicated nature team, companies can generate LEAP-aligned outputs that support both compliance (e.g., with CSRD) and early-stage strategy.

Don’t overcomplicate it with consultants - at least not at the start. While external advisors may be helpful later in the journey (e.g. for CSRD interpretation or advanced biodiversity metrics), many of the early steps are fully manageable in-house, especially with intuitive tools that offer automation and built-in methodologies.

Leverage new guidance resources. Dunya Analytics published a Getting Started Guide, designed to walk teams through the mindset, steps, and available tools for nature risk assessment. It outlines how to use existing climate reporting processes as a springboard and what to prioritize in early disclosures.

The bottom line

Nature risk may be complex, but managing it doesn’t have to be chaotic. With platforms like Dunya Analytics, organizations can move from information overload to insight, from ad hoc analysis to integrated strategy. By aligning with frameworks like TNFD and embedding nature into core risk and ESG systems, companies not only reduce exposure, they position themselves to lead in a nature-positive economy.