Interview with Kana Earth: Building the Digital Backbone of Nature Capital

Investing in nature is essential for tackling climate change and biodiversity loss, yet the process remains slow, fragmented, and risky. From inconsistent carbon pricing to cumbersome project management, barriers in the natural capital market prevent private finance from reaching the high quality restoration projects that need it.

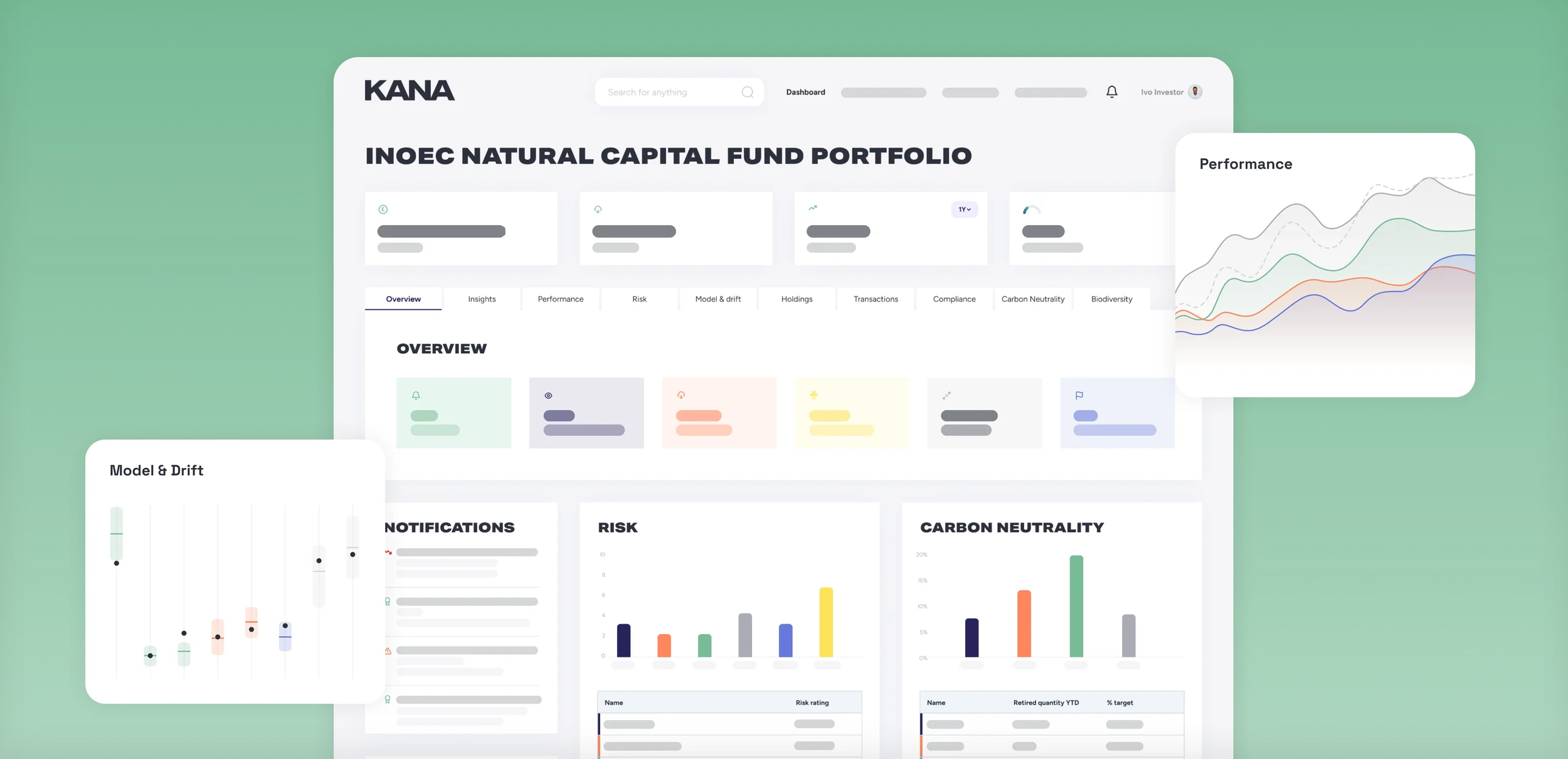

Kana Earth is working to fix this. Their platform connects landowners, project developers, asset managers, and investors in one place, providing the infrastructure and data needed to manage projects, track performance, and build trust in nature-based solutions. By making it easier to deploy capital with confidence, they aim to scale restoration efforts and make natural capital a routine part of investment portfolios worldwide.

In this Ask the Expert interview, the team at Kana Earth explains the gaps in today’s natural capital market, how digital tools can close them, and what it will take to channel more private finance into projects that deliver measurable climate and biodiversity gains.

Q. Tell us about the challenges Kana Earth seeks to solve. Why is it so important to bring more private capital into projects tackling nature restoration and the climate crisis? Why is it important we act now to address this? What if we don’t act enough, at all or in time?

Kana Earth aims to tackle the major challenges in Natural Capital investment, a space that remains complex, inefficient and difficult to navigate. Investors face significant hurdles in raising, deploying and managing capital effectively due to the lack of essential market infrastructure. Similarly, project suppliers make do with fragmented systems, onerous data handling, and a lack of robust tooling to assist them in delivery. Key issues include inconsistent carbon pricing, non-standardised project data, and manual, inefficient coordination among stakeholders. These factors create high barriers to entry for private capital, the capital that is urgently required to meet global climate and biodiversity targets.

Kana Earth provides a digital infrastructure designed to de-risk investments and streamline the entire project lifecycle. Our platform connects all participants in the investment chain from landowners and project developers to asset managers and investors, while offering essential market tools to scale this sector. By linking high-quality nature restoration projects with the capital they need, we enable investors to deploy funds confidently and efficiently.

Climate risks are escalating, with the UK Institute and Faculty of Actuaries’ 2024 Planetary Solvency report warning of economic instability if ecological thresholds are breached. Traditional risk models fail to capture the full impact of climate collapse, but strategic investments in nature restoration can mitigate hazards and safeguard portfolios. Private capital plays a crucial role in bridging the funding gap, and Kana Earth exists to accelerate this investment making it more efficient, scalable, and impactful to meet the demands of our future.

(Image Credits: Adobe Stock)

Q. How do you define ‘natural capital’? Why is natural capital currently underutilized as an asset class? What are the current barriers to taking action here as you see it?

Kana Earth defines natural capital as the planet’s stock of natural assets including: forests, farmland, soils, freshwater systems, and biodiversity, that can be packaged to deliver a defined nature-positive outcome alongside financial returns, whether that be carbon reduction, biodiversity uplift, or flood risk reduction. Without ecosystem services, long-term economic growth and portfolio resilience are fundamentally at risk. Rather than viewing Natural Capital as a distinct asset class, Kana Earth considers it an investment theme that spans multiple private markets.

Despite its importance, natural capital remains underutilised as an investment strategy due to historically unpriced environmental degradation. However, as awareness of climate change grows, corporations are increasingly incorporating these costs into their pricing models. The expansion of emissions trading schemes and the financialisation of ecosystem services are driving greater recognition of nature’s value among investors. As corporations, investors, and governments acknowledge the necessity of private capital in safeguarding their portfolios, investment in this sector is expected to accelerate.

A key barrier is the lack of clear differentiation between high- and low-integrity nature-based credits, creating investor hesitation and reputational concerns. UK carbon markets distinguish themselves from REDD+ credits by prioritising quality and integrity, allowing investors and corporations to participate with confidence. Kana Earth helps distinguish these credits by providing digital infrastructure and transparent data, ensuring every credit is backed by verifiable, evidence-based impact, restoring trust and accelerating investment in nature.

Q. Tell us about Kana Earth - the work you do, and how you are doing it? What’s unique about your approach? How is technology helping you to solve nature problems in new ways? Does your solution make use of AI, if so, how?

Kana Earth’s mission and approach:

Kana Earth is dedicated to establishing Natural Capital as a medium-risk investment strategy, seamlessly integrated into portfolio allocations across private markets. To achieve this, we are revolutionising the way market participants interact, both on the supply and demand sides, by providing a digital infrastructure that enhances efficiency, transparency, and scalability.

We offer two core products:

Kana Hub: A comprehensive suite of tools designed for stakeholders involved in delivering nature-based projects. It streamlines project creation and management through end-to-end workflows, audit trails, and centralised document storage, significantly improving operational efficiency and transparency. Its intelligent monitoring system enables large-scale project tracking, offering advanced health indicators for continuous performance assessment.

Kana Seed: A data-driven platform that enables asset managers and corporations to build and manage Natural Capital portfolios. It provides advanced project and portfolio oversight, integrated valuation tools, and full reporting capabilities, ensuring informed decision-making and optimized investment strategies.

(Screengrab from Kana Earth’s website)

Our approach is unique in its emphasis on digital collaboration across the entire ecosystem. By integrating technology into every stage of the investment process, we enable a scalable market where Natural Capital becomes a viable and attractive investment theme.

On leveraging AI to solve nature challenges:

We use AI language models, in concert with OCR character recognition techniques, to parse and digitally extract manually completed application forms under various UK natural capital schemes. This allows us to structure the forms into sensible data sets that can be better queried and aggregated upon.

We are currently building upon this framework, introducing GTP 4o’s prompt functionality into our platform and vectorising the extracted applications, allowing users to ask questions, compare data points across initiatives, and get a clearer understanding of the projects they’re developing or investing in.

Q. Who does Kana Earth serve? Who would be the main users of your solution and how do they benefit from your solution?

Kana Earth primarily serves asset managers deploying capital into Natural Capital. Our platform equips them with the tools necessary to effectively manage their portfolios, monitor project progress, and ensure that expected outcomes are delivered. With real-time insights into the performance of their natural capital assets and built-in bespoke risk analysis, asset managers can track key metrics, assess project-specific risks, and make informed investment decisions with confidence and transparency.

However, our solution is built to serve the entire investment chain. From landowners and project developers to verification bodies, Kana Earth fosters a unified, data-driven ecosystem where each stakeholder can collaborate efficiently. Projects undergo digital verification, which is authenticated on the platform and fully accessible to investors tracking the projects.

By connecting these stakeholders on a single platform, Kana Earth is driving trust, efficiency, and scalability in the Natural Capital market, accelerating investment and impact across the sector.

Q. What’s the story behind Kana Earth? Is there a story behind the company’s name? Who are the people behind it and how did the company get started in the first place? How has your journey evolved until now?

Kana Earth was founded in response to a real-world challenge encountered by our CEO, Andy Creak. In 2020, while working to make his helmet company carbon neutral, Andy sought to purchase carbon credits but quickly realised how complex, fragmented, and inefficient the process was. The market lacked the digital infrastructure necessary to make environmental action both accessible and trustworthy. Since its inception, Kana Earth has grown significantly, with approximately 50% of UK project developers now onboarded onto the platform. Looking ahead, we plan to expand beyond the UK, further scaling the Natural Capital investment sector and driving greater efficiency, transparency, and accessibility in global environmental markets.

Q. Where are you going next? What are you working on at the moment? What’s on your current roadmap - and what’s your long-term vision?

Right now, we are focused on building new features specifically designed for project developers and those managing projects on behalf of investors, enabling them to more effectively manage and scale their nature-based projects. We are planning to extend our platform to support markets beyond the UK and expand the use of AI across the platform.

Our long-term vision is ambitious; we want to see Natural Capital become a core part of global investment strategies. Our goal is for at least 2% of every pension portfolio to be allocated to Natural Capital and for those funds to be managed through the Kana platforms.

Q. Given the recent COP16 Biodiversity Summit and changing political landscape, how do you currently see the direction of travel in terms of the area you operate in? Do you think awareness of challenges and solutions is growing? How does regulation play a role here?

Despite political shifts and ESG debates investment in nature remains fundamentally sound from both a risk management and returns perspective. Nature is a foundational pillar of the global economy, supporting supply chain stability, insurance markets, and long-term asset resilience. Restoring and preserving natural ecosystems is a strategic approach to risk mitigation. Ecosystem degradation and climate change threaten financial stability, with funds like Norway’s Sovereign Wealth Fund assessing natural capital risks across 96% of its portfolio.

Regulation is key to expanding carbon and ecosystem service markets, with 24% of global emissions covered by pricing mechanisms, driving incentives for action. Strong regulatory frameworks build investor trust, accelerating capital into nature-based solutions.

Kana Earth is developing digital infrastructure to support this shift, providing data transparency, integrity, and collaborative tools that enable investors and landowners to navigate regulation and unlock nature’s investment potential.

Q. Are you able to share one or more of your favorite success stories to date?

A key milestone for us was hosting a series of workshops with seven leading asset managers in the natural capital investment space, including Gresham House, Aberdeen, Oxygen Conservation, and many others. Across 12 sessions, we tackled critical topics such as pricing data, insurance structures, and cost-effective project monitoring. The insights gathered directly shaped our roadmap and led to the creation of the Carbon Valuation Model. Developed in partnership with Forest Carbon, this model leverages macroeconomic factors, project specifics, and advanced machine learning simulations to deliver transparent, data-driven carbon credit valuations that account for price volatility and market risks, enabling smarter investment decisions. Providing asset managers with the tools they need for natural capital investing is exactly what Kana Earth was designed to do and reinforces our commitment to being the digital infrastructure backbone of the UK’s nature markets.

Q. Where does Kana Earth sit within the broader category of nature tech? Do you see the evolution and growth of nature tech as a category as directly supporting the work you do?

Kana Earth operates at the infrastructure layer of the nature tech ecosystem, serving as the digital backbone that enables asset managers to invest in Natural Capital with confidence and efficiency. While many nature tech solutions focus on monitoring, measurement, and modelling, Kana Earth integrates these insights into a comprehensive system that supports financial decision-making and stakeholder coordination across the entire investment chain.

The continued growth and evolution of nature tech directly supports our mission by enhancing the quality, accuracy, and accessibility of environmental data for guiding investment decisions.

Two particularly promising areas of focus are biodiversity and natural flood management (NFM). The impacts of climate change are already evident in the form of species loss and increased flood events. Accelerating innovation and scaling solutions in these areas delivers widespread benefits and financial incentives can help supercharge this momentum.

Kana Earth’s platform is built using NatureScript, a flexible coding framework that allows us to rapidly integrate new scientific standards as they emerge. This ensures that as sectors, such as biodiversity mature, Kana is ready to operationalise investment at scale.

Q. What led you to the Nature Tech Collective? How do you think Kana Earth benefits from being associated with the community?

We joined the Nature Tech Collective because we believe that collaboration is key to scaling impact. The community brings together the brightest minds and boldest solutions and offers a space for knowledge sharing, co-creation, and collective action.

It’s also a powerful platform to elevate the nature tech narrative and speak with a unified voice to regulators, investors, and the broader public.

Q. How can others support the work you do and what kind of support would be of most use to your organization’s goals right now?

To advance the work of Kana Earth, we encourage asset owners to take a proactive approach in exploring the Natural Capital sector. This begins with a comprehensive assessment of their current portfolios, evaluating nature-related impacts and risks. Understanding how investments intersect with biodiversity loss, ecosystem degradation, and climate vulnerability is a crucial step toward building more resilient and future-proof portfolios.

We urge asset owners to allocate a portion of their portfolio to Natural Capital, enabling asset managers to establish dedicated funds that actively support nature recovery and climate resilience. By directing capital into this sector, investors can drive meaningful environmental impact while securing long-term financial returns.

When combined with Kana Earth’s technology, these investments facilitate large-scale nature restoration, creating a more transparent, efficient, and scalable market for Natural Capital. Collaboration and strategic investment are key to accelerating a sustainable global economy.

To learn more about Kana Earth’s mission and explore their latest work in natural capital investment and nature-based solutions, visit www.kana.earth or follow them on LinkedIn.